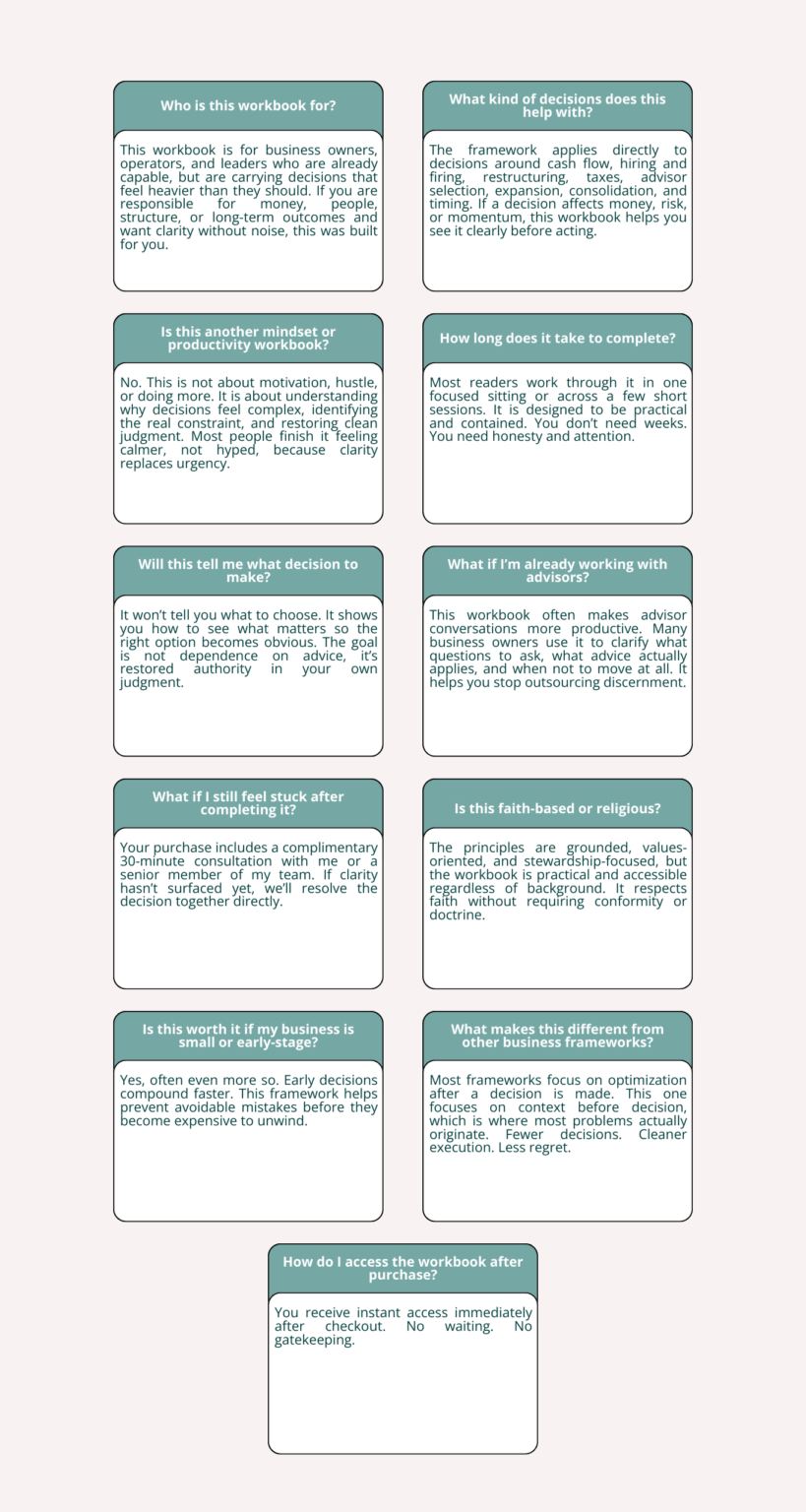

Guarantee: If the workbook doesn’t surface the decision that’s costing you momentum,

your purchase includes a complimentary 30-minute consultation to resolve it directly.

INDECISION IS A PROFIT LEAK

If a decision in your business has lingered for 30+ days, it’s already costing you money even if revenue looks fine.

In under 30 minutes, this workbook will:

➜ Show you exactly what decision to make next

➜ Remove mental noise and second-guessing

➜ Force clarity using a repeatable framework

No motivation.

No mindset fluff.

Just a system that makes indecision expensive.

Indecision isn’t a personality flaw.

It’s a missing structure.

This workbook installs:

➜ A decision-filter used by operators who move fast

➜ A method to eliminate “option paralysis”

➜ A framework you’ll reuse every time you stall

Once you see it, you can’t unsee it.

This is for you if you’re a business operator responsible for:

➜ Cash

➜ People

➜ Structure

Profit rarely disappears all at once. It leaks through:

➜ Delayed hires or overdue firings

➜ Cash sitting idle or trapped

➜ Tax decisions made too late

➜ Banking structures that limit leverage

Waiting feels safe. It’s not.

Most resources tell you what’s important. They don’t tell you what to decide next.

This workbook gives you:

![]() A Prioritization Sequence

A Prioritization Sequence

![]() Decision Filters for Money and Risk

Decision Filters for Money and Risk

![]() Clarity on What Delays are Already Costing You

Clarity on What Delays are Already Costing You

So decisions stop dragging and profits stop leaking.

This is not a mass-market product.

Access is limited to maintain quality and support.

When this closes, it closes.

There is no waiting list.

You already know what to do.

People who win don’t wait until they “feel ready.”They decide...then execute.

This is that moment.

The modern family office prides itself on sophistication. Complex structures. Tier-one advisors. Beautiful reports. And yet, families are still fracturing, heirs are still…

In a world obsessed with growth, the most powerful families are often the least visible.They refuse unnecessary scale. They avoid performative expansion. They…

The concept of a sovereign wealth fund (SWF) sounds lofty, almost untouchable, something reserved for nations managing oil revenues or state…

Sovereign wealth funds (SWFs) are the pinnacle of financial discipline and strategic investment. These funds, managed by nations to preserve…

For decades, Social Security has been touted as the safety net for retirees, a promise that you’ll be taken care of….

Every family dreams of building a legacy that lasts, but the real challenge lies in preserving it. Without careful planning,….

Philanthropy and strategy are not mutually exclusive. The ultra-wealthy have long understood that giving back doesn’t just feel good, it’s also….

In an age where privacy is a luxury, protecting your personal information, especially your Social Security Number (SSN), is critical. When setting…

Tax season tends to elicit a collective groan from everyone except, perhaps, the ultra-wealthy. You see, they’ve mastered a subtle

The ultra-rich don’t just grow their wealth, they fortress it. At the heart of this financial invincibility lies a powerful, timeless…

For decades, the 401(k) has been marketed as the cornerstone of retirement planning, but beneath the surface lies a system….

Sovereign wealth funds (SWFs) are the pinnacle of financial discipline and strategic investment. These funds, managed by nations to preserve…

TMW Advisory is a private business advisory firm and is not a law firm, or CPA firm. The content provided on this website is for general informational purposes only and does not constitute legal advice. No professional relationship is created by visiting this site, and clients should consult licensed professionals for all decision-making, implementation, or reliance on any information presented here.